Click here to download a copy of the PDF

The Unavoidable

Opportunity:

Lead Author: Lori Collins

Contributors: Umar Ashfaq, Turbold Baatarchuluu, Erica Downing, Tara Guelig, Jay Koh, Linda-Eling Lee

March 2024

A discussion paper by:

Global Adaptaon &

Resilience Investment

Working Group

Data and analysis by:

In partnership with:

Investing in the Growing Market

for Climate Resilience Solutions

Global Adaptation &

Resilience Investment

Working Group

Table of Contents

Executive Summary 3

Adaptation Investment Thesis - Scope of Opportunity

5

Identifying Adaptation Solutions Companies

11

Approaches to Portfolio Construction for Thematic

Exposure

16

Conclusion

21

About

22

Disclaimer

25

I.

II.

III.

IV.

V.

VI.

Table of Figures & Tables

Uses of Climate Finance 2021/2022

5Figure 1:

Billion Dollar Disasters

6Figure 2:

Examples of Adaptation Solutions by Sectors

and Hazards

8Figure 3:

Taxonomies for Resilience Investment

11Figure 4:

Description of an Adaptation Solution Company

12Figure 5:

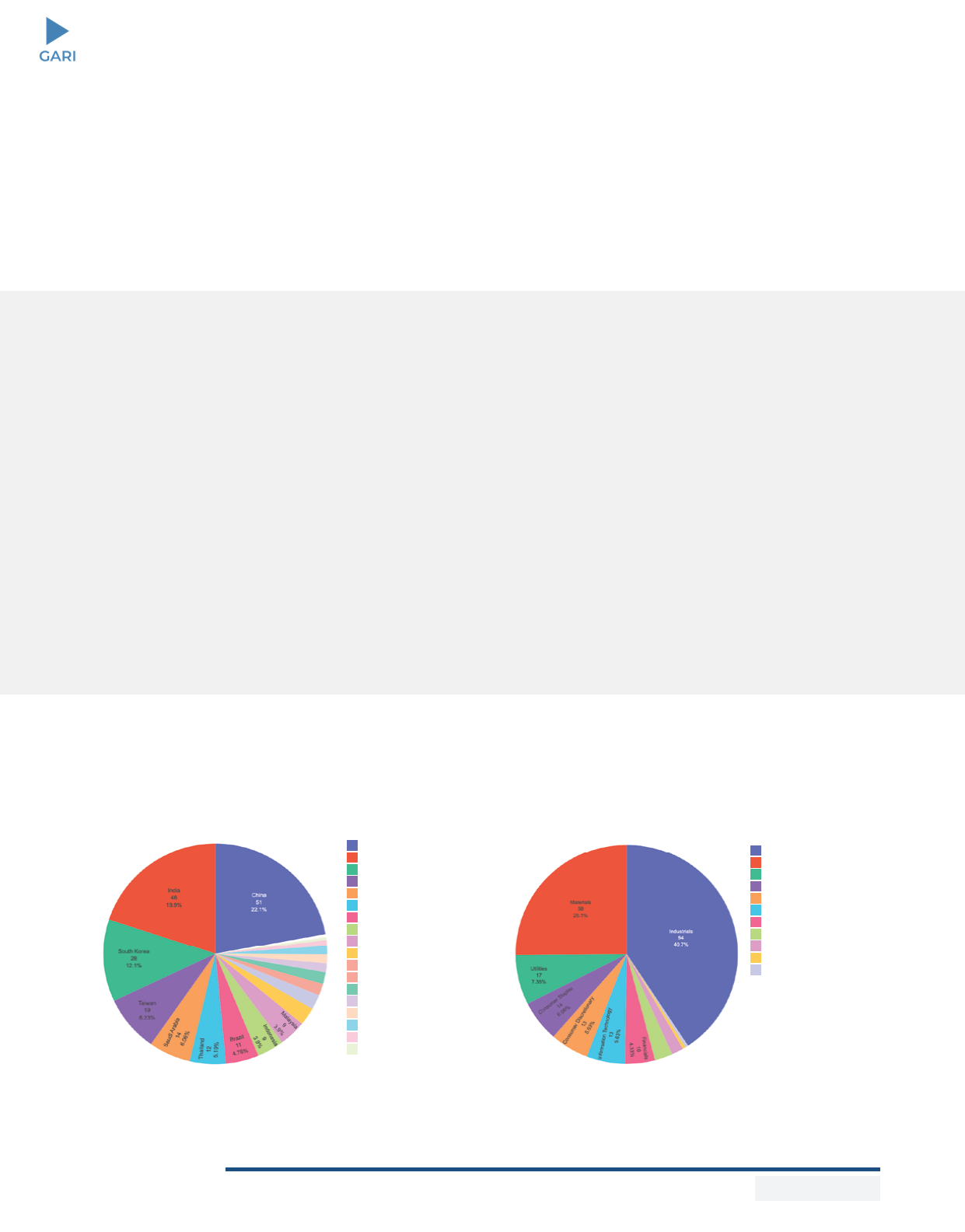

First Cut of Resilience Company Universe

17Figure 6:

Resilience Companies by Sector - First Cut

18Figure 7:

Resilience Companies by Country

18Figure 8:

Resilience Emerging Market Companies by Nation

19Figure 9:

Resilience Emerging Markets Companies by Sector

19Figure 10:

Illustrative List of Current Climate Hazards,

Risks and Impacts

7Table 1:

References

23VII.

The Unavoidable Opportunity: Investing in the Growing Market for Climate Resilience Solutions

Page 2 of 25

March 2024

I. Executive Summary

The growing urgency of climate change

has generated two related investment

opportunities: the need to reduce the

causes of climate change through

investments in decarbonization

and the need to manage mounting

physical effects through investments

in climate resilience. Technologies

and solutions that can reduce the risks

and impacts of climate change are

growing in demand, generating related

and attractive growth opportunities for

investors. Governments are planning

ood defenses, companies are

hardening their physical infrastructure

and supply chains, and households are

protecting themselves against extreme

heat.

Climate resilience investments are

fundamentally attractive for several

reasons. There is now greater certainty

around the near-term trajectory of

climate change and the demand

drivers for climate resilience, which are

uncorrelated and independent from

other market forces. Climate resilience

measures can support investible

opportunities that leverage the power

of nature-based solutions and enhance

biodiversity. Because physical climate

impacts will disproportionately affect

the poorest and most vulnerable

populations and nations, climate

resilience solutions can also advance

equity and environmental justice

Climate resilience and adaptation is an attractive growth investment theme

that is investible today, including through publicly listed companies.

considerations. Yet climate resilience

is substantially underinvested and, we

believe, not priced into markets, leaving

open greater opportunity for investors.

Climate resilience investments are

not well understood by investors,

and therefore practical frameworks

are needed to inform investment

decisions. Few companies today

self-identify as “climate resilience” or

“adaptation” companies.

*

However,

established, market-driven approaches

can be used to identify companies

that provide climate resilience and

adaptation solutions. Many taxonomies

exist to identify climate resilience

companies, yet these models may be

limited to specic regions, focus only

on emerging technologies, or tend

towards needs assessments rather

than solutions. In order to provide a

comprehensive approach, considering

all regions and companies, a new model

has been developed and peer-reviewed

for identifying climate resilience

and adaptation companies, and is

introduced in this paper as the “CRISP

Framework.”

Publicly traded companies offer

an opportunity to invest at scale in

climate resilience and adaptation.

A new market analysis that applies

the climate resilience framework to

publicly accessible data has identied a

Global Adaptation &

Resilience Investment

Working Group

The Unavoidable Opportunity: Investing in the Growing Market for Climate Resilience Solutions

Page 3 of 25

March 2024

*

Adaptation and resilience are two related parts of a continuum of strategies to address the effects of climate

change: Adaptation refers to systemic adjustments to climate change, while climate resilience refers to the ability to

recover from risks and impacts of climate change. These terms will be considered together in this paper.

Spotlight on Emerging Markets – Executive Summary

Emerging markets across the globe represent $6.5 trillion

1

in total market

capitalization and are expected to outpace the growth of developed markets

by 2030.

2

Climate change, however, is one of the top risks to these economic

projections.

3

As a result, demand for adaptation solutions in emerging markets

is ripe for growth to address climate hazards on the horizon and already occur-

ring at record pace. This paper includes a new analysis mapping companies

that provide adaptation solutions listed in 47 markets worldwide, including 24

emerging markets (see Section IV). Of the 827 companies identied globally,

231 were listed in emerging and developing countries, demonstrating that a

sizeable share of the potential investment opportunity for climate resilience

solutions is based in the Global South.

universe of over 800 public companies

that offer climate resilience and

adaptation solutions. This universe of

solutions offers broad access to the

adaptation investment growth theme

for additional capital to support a

variety of public markets investment

approaches. Investors in private

companies have already demonstrated

opportunities for investments in climate

resilience and adaptation solutions, and

the market is ready to move beyond

private equity to larger, more substantial

investments in publicly traded

companies.

This paper presents an initial toolkit for

investors considering climate resilience

as a thematic area, particularly in public

markets. It describes:

• Why climate resilience solutions

offer a compelling investment

thesis from a returns perspective

• What is meant by climate

resilience solutions: the products,

technologies, and services that are

in growing demand as households,

companies, and governments

seek to protect the economy and

communities from escalating

physical climate risk

• A proposed framework to dene

which companies are “in the

business of resilience”

• Methods to locate these companies

within the investable universe of

publicly listed companies

• How investors can design

investment products to provide their

clients with exposure to the theme

Global Adaptation &

Resilience Investment

Working Group

The Unavoidable Opportunity: Investing in the Growing Market for Climate Resilience Solutions

Page 4 of 25

March 2024

II. Adaptation Investment

Thesis – Scope of Opportunity

Climate change is creating a compelling investment opportunity in the

category of climate resilience.

Climate change is a humanitarian

tragedy and planetwide emergency

with devastating impacts and human

costs. The direct and ensuing effects

of climate change are bearing down on

all geographies, all segments of society

and all economies. Last year, the World

Meteorological Organization (WMO)

reported that almost 12,000 extreme

weather, climate, and water-related

events over the past 50 years have

caused over $4.3 trillion in losses.

4

In

2022, natural disasters caused global

economic losses of $313 billion, of

which less than half was insured.

5

In

the U.S. alone, climate and weather

disasters have caused roughly $120

billion in damages per year since 2017.

6

The urgency for action has accelerated

with United Nations Intergovernmental

Panel on Climate Change (IPCC)

warning in 2023 is that the world is

“risking severe damages, costs, and

upheaval.”

7

Solutions to climate

change are essential.

By now investors are familiar with

decarbonization as a growth investment

thesis. Billions of dollars of capital have

shifted into renewable energy, electric

vehicles, energy storage, and low

carbon solutions for everything from

agriculture to infrastructure as investors

have recognized the opportunity for

returns created by the growing urgency

to address the causes of climate

change.

Resilience to the effects of climate

change has similar drivers, arguably

even more fundamental and more

certain ones. The need to climate-

proof economies and societies

will grow inexorably in the coming

decade regardless of the pace of

decarbonization. Yet to date, nancing

for adaptation has been framed around

the cost, primarily to governments, of

hardening economies and communities

to physical climate risk. Because they

are viewed only as costs, investments

in adaptation have been miniscule

compared to those in decarbonization.

Climate Policy Initiative (CPI) estimated

$1.3 trillion annual average investments

into climate-related equities, bonds,

projects, and assets in 2021/2022,

almost double the previous period.

8

Although less than 5% of this ow - $63

billion - was for adaptation, investment

Global Adaptation &

Resilience Investment

Working Group

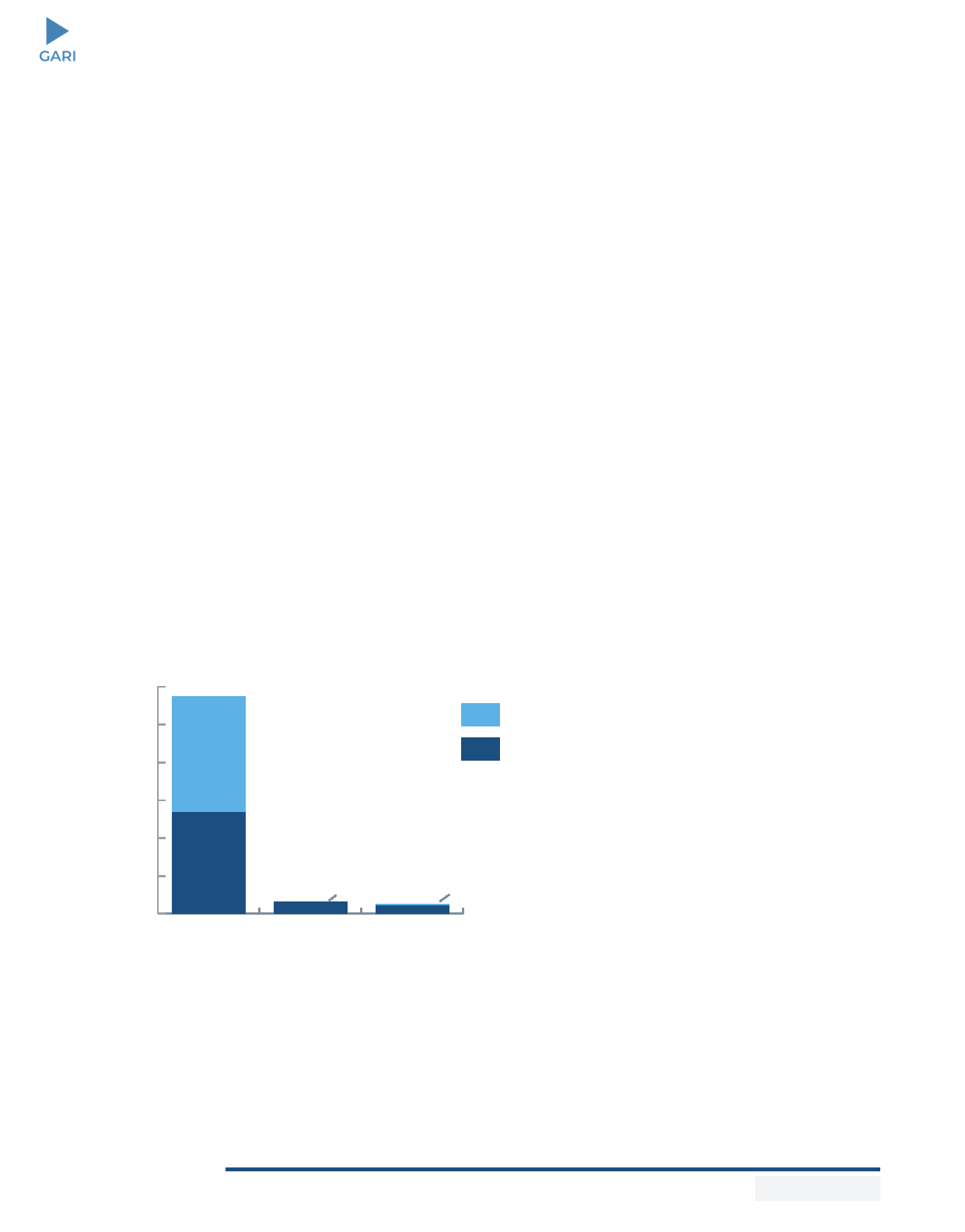

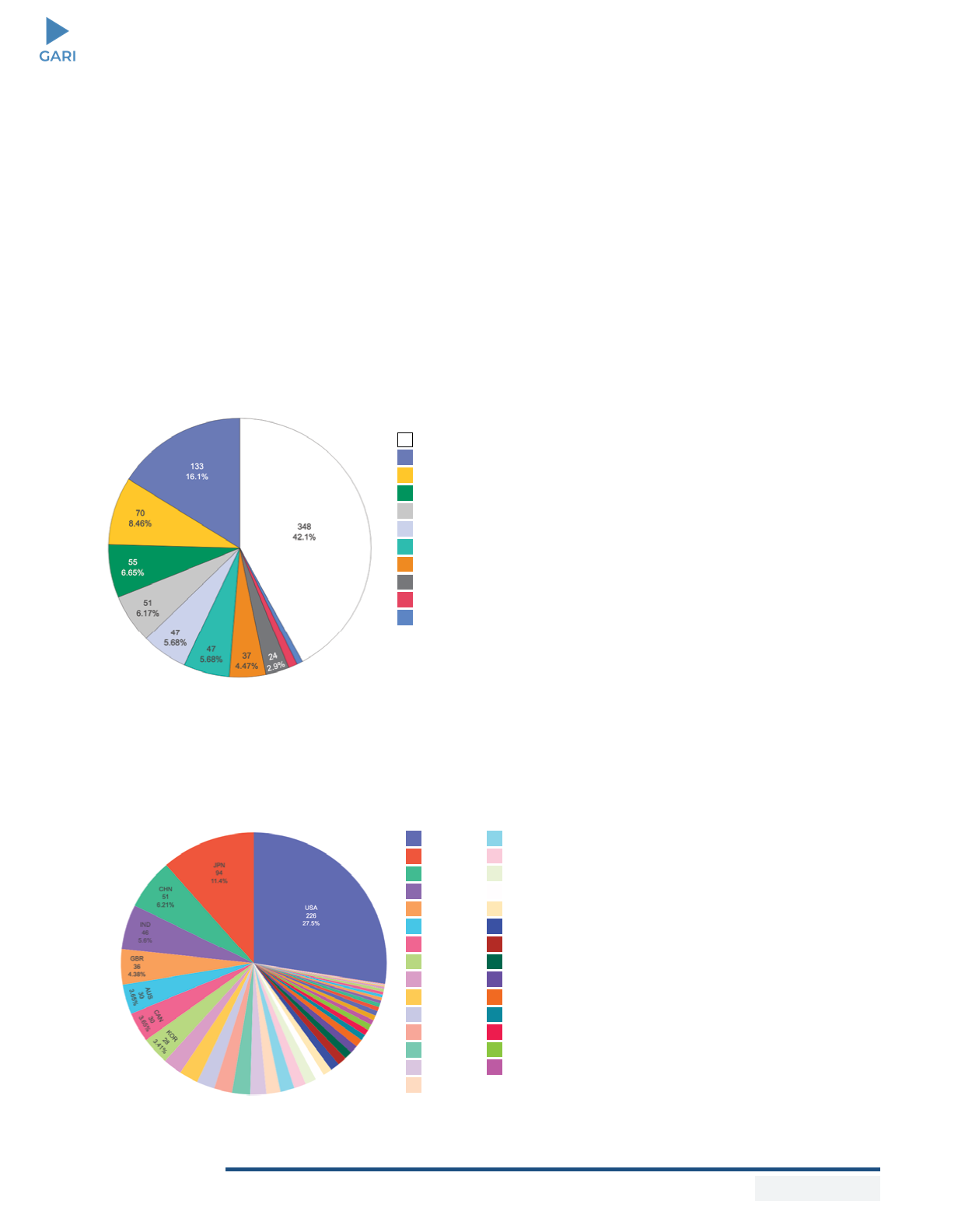

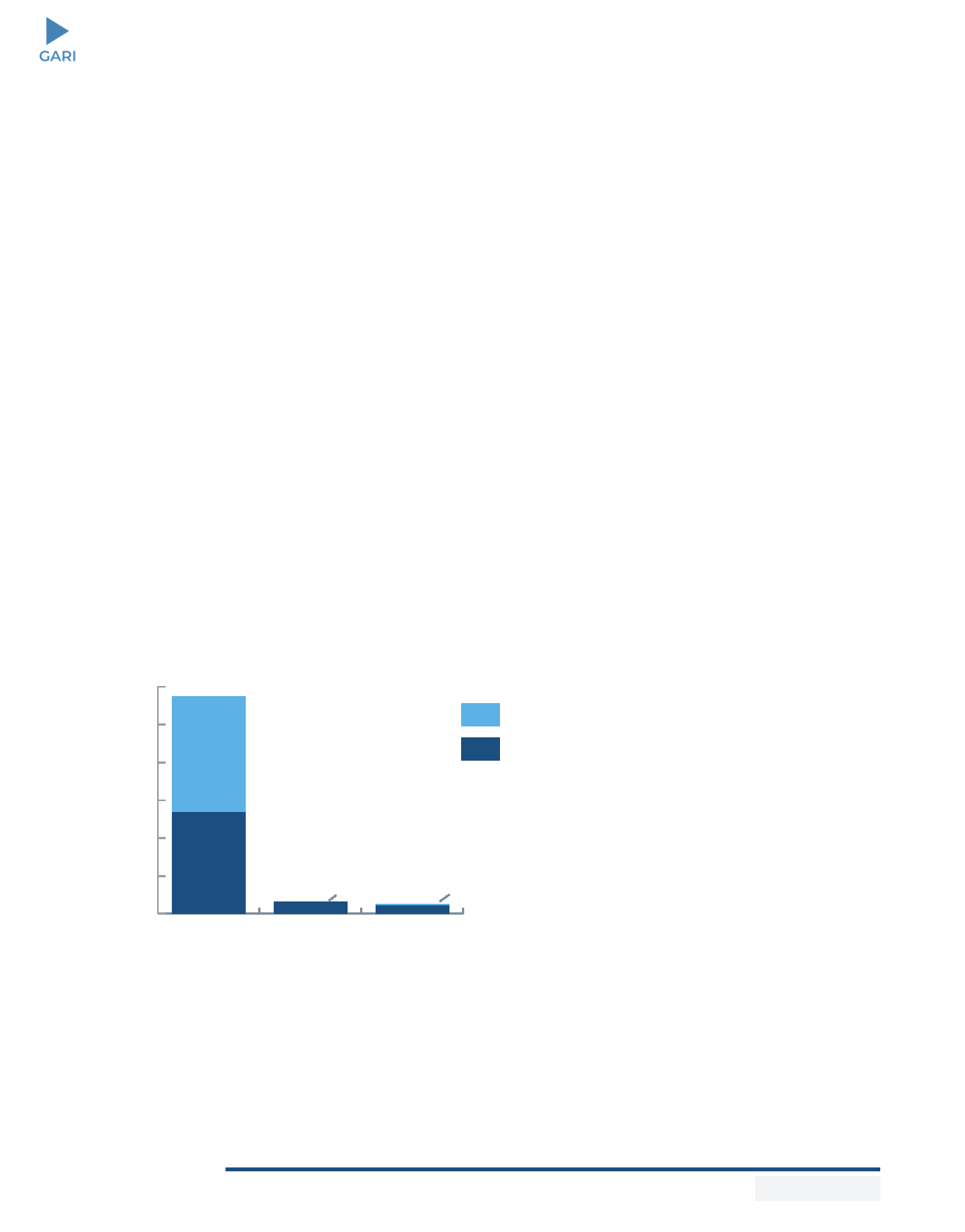

Figure 1: Uses of Climate Finance 2021/2022

Source: Climate Policy Initiative, Global Landscape of Climate Finance 2023, p21

0

200

400

600

800

1000

1200

Private

Public

Dual BenefitsAdaptationMitigation

614

536

62

42

USD

Billions

1.5 9

The Unavoidable Opportunity: Investing in the Growing Market for Climate Resilience Solutions

Page 5 of 25

March 2024

grew 29% from $49 billion in the prior

period. That said, nearly all adaptation

was funded by public actors (98%)

according to CPI,

9

which leaves just

$1.3 billion in identied and tracked

private sector investment in adaptation

2021/2022 across the globe. The

private sector drives almost half of

nancing for renewable energy, but has

not yet systematically focused on the

escalating demand for adaptation

10

as

shown in Figure 1 above.

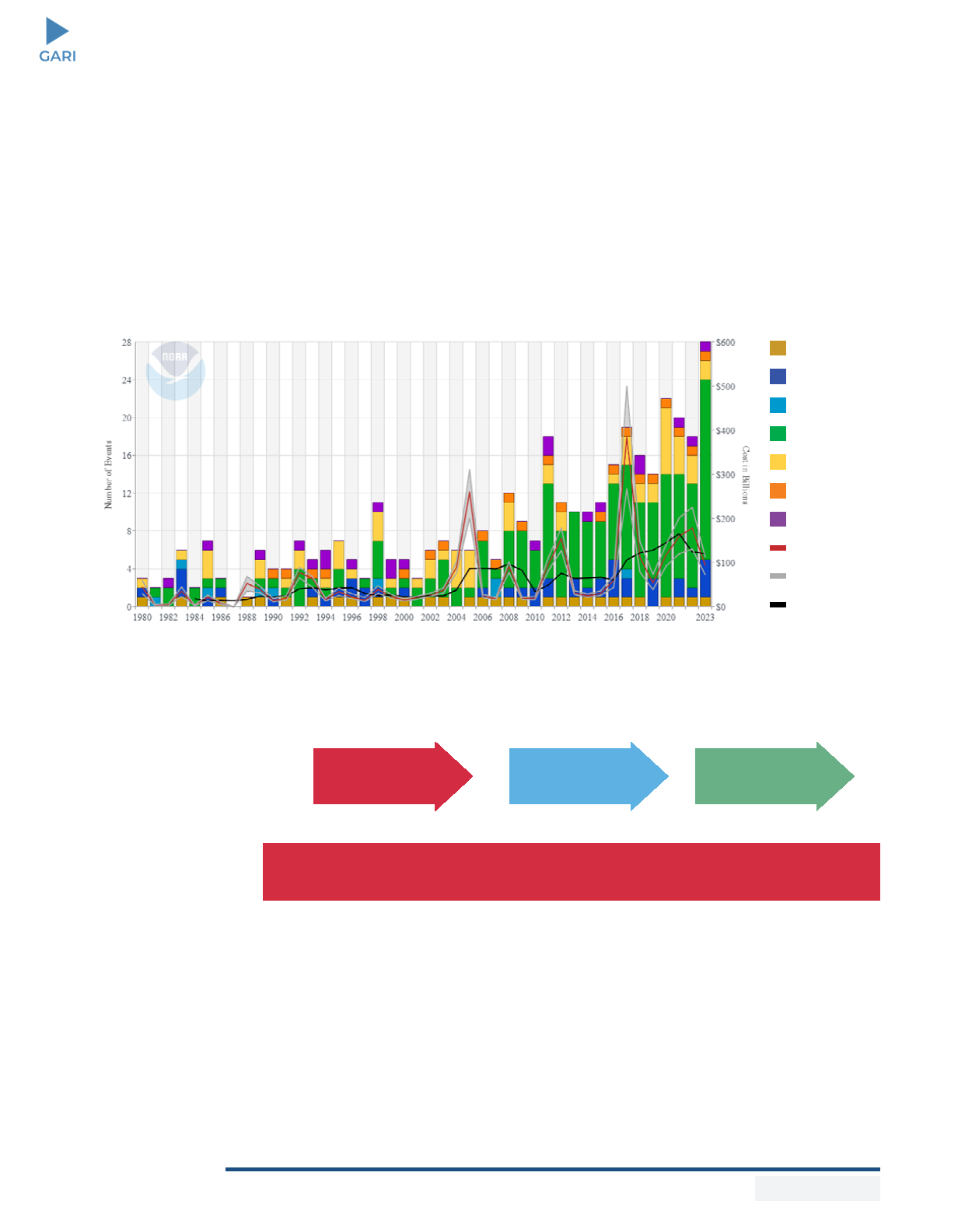

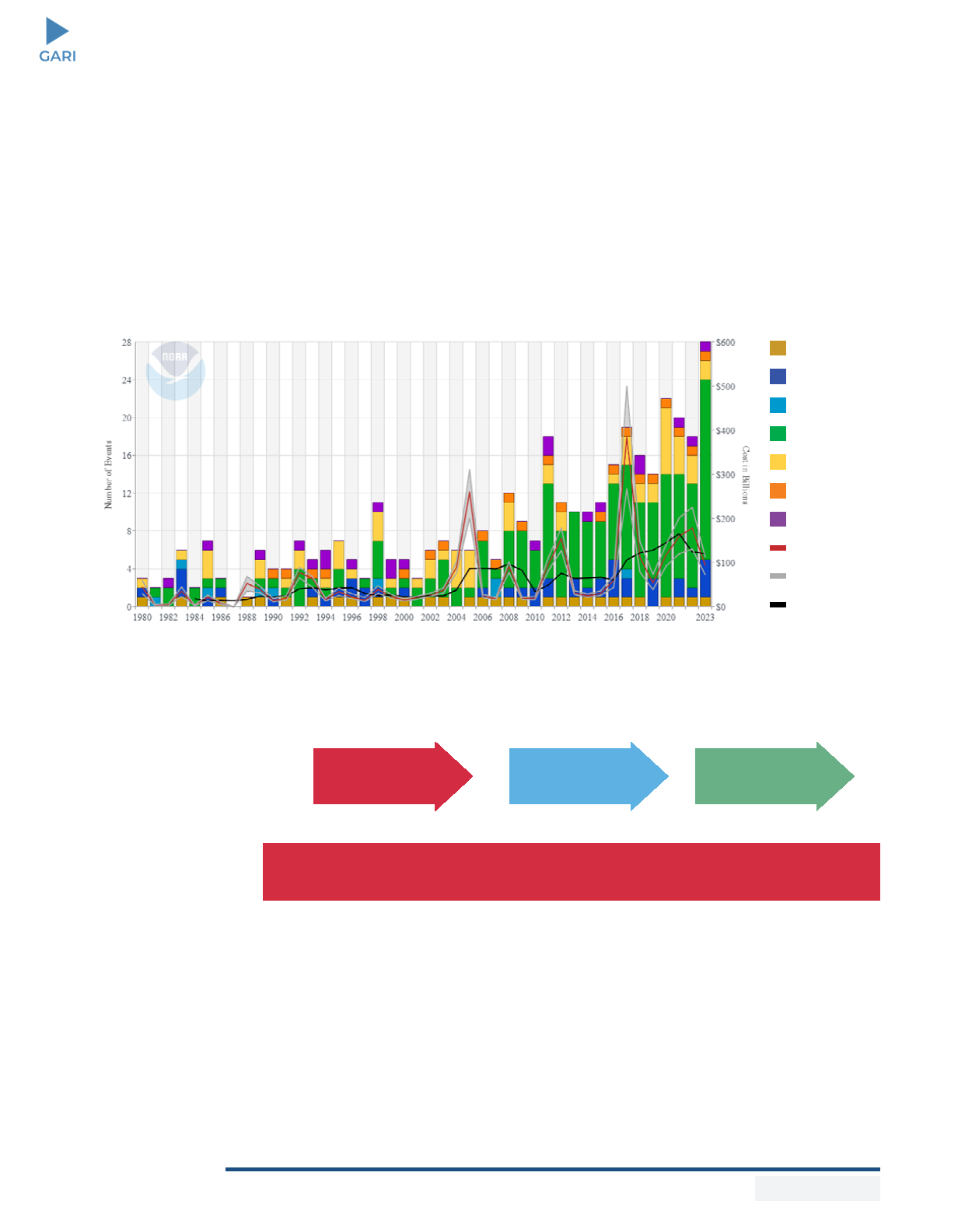

Figure 2: Billion Dollar Disasters

United States Billion-Dollar Disaster Events 1980-2023 (CPI-Adjusted)

Citation: NOAA National Centers for Environmental Information (NCEI) U.S. Billion-Dollar Weather and Climate Disasters (2023). https://www.ncei.noaa.gov/access/billions/, DOI:

10.25921/stkw-7w73

Drought Count

Flooding Count

Freeze Count

Severe Storm

Count

Tropical Cyclone

Count

Wildre Count

Winter Storm

Count

Combined

Disaster Cost

Costs 95% CI

5-Year Avg

Costs

Climate change is generating increasing and

more certain risks and impacts.

1

There is greater certainty around the

near-term trajectory of climate change

and the demand drivers for climate

resilience. Even with solid progress

on decarbonization, the scientic

community’s latest IPCC v.6 report

projects 1.5C degrees of warming in

almost all scenarios within the next 10

years, which will highly likely increase

impacts on society and the global

economy. Demonstrating just how

evident these impacts already are, the

U.S. suffered billion-dollar climate

catastrophes 28 times in 2023, the

highest number of disasters ever in

a calendar year, as shown in Figure

2 below.

11

The need for adaptation

nance in developing countries is even

more cogent; requirements are 10 to 18

times as large as international public

nance ows.

12

In our view, the climate resilience growth investment opportunity is

based on three overarching drivers:

Investment

Opportunities in Climate

Resilience Companies

Demand for Climate

Resilience Solutions

Increasing Climate

Risks & Impacts

Global Adaptation &

Resilience Investment

Working Group

The Unavoidable Opportunity: Investing in the Growing Market for Climate Resilience Solutions

Page 6 of 25

March 2024

Climate hazards will increase risks

and impacts across the economy,

as indicated in Table 1. Expected

climate risks and impacts are well-

documented by the IPCC and other

global climate organizations. Many of

these impacts are already evident, with

future damages likely to be enormous

given the lock-in of greenhouse gas

emissions over previous decades. As a

result, the costs of climate adaptation

will grow only more expensive with the

passage of time. Climate change may

represent more certainty of risk and

impact over the next ten years than

potential economic effects of interest

rates, ination, articial intelligence,

consumer preferences, or other

factors that can affect investment

performance.

Climate risks and impacts are generating increasing demand for

technologies and solutions that build resilience and adaptation.

2

As climate risks and impacts increase,

demand for new technologies and

adaptations solutions is accelerating.

Financial regulators and central banks

have pointed to the physical impacts

of climate change as a material and

potentially systemic risk for nancial

markets. In the insurance sector,

climate change is now the top risk -

higher than cybersecurity - according

to the 12th Annual Survey of Emerging

Risks.

16

Institutional investors,

insurance companies, pension funds

and other asset managers are keen

to understand these climate risks as

well as the opportunities to improve

investment performance.

Companies understand that climate risk

matters and are actively considering

it in their strategies. A group of over

200 of the world’s largest corporations

reported $1 trillion in estimated

nancial risk from climate change.

17

Accordingly, companies in most

sectors, including 69% of biotech,

healthcare, and pharma companies,

83% of retailers, and 88% of nancial

services rms, are actively integrating

climate change impacts into their

respective business strategies.

18

Efforts to deepen understanding

of potential risks are supported by

emerging climate data and analytics

companies, articial intelligence

and many other tools such as earth

observation, remote sensing, and

satellites. Increasingly robust data

gives companies the tools to translate

these risks into opportunity costs to

help justify investments in adaptive

technologies.

All sectors from agriculture, water,

transportation, energy, nancial

services, and healthcare must

adapt to new climate conditions

while decarbonizing in tandem.

Agricultural analytics, water efciency

solutions, supply chain analytics, grid

reliability, advanced insurance, and

Global Adaptation &

Resilience Investment

Working Group

Table 1: Illustrative List of Current Climate

Hazards, Risks and Impacts

Key Climate

Hazards

Extreme

Temperatures

Drought

Extreme

Storms

Sea Level

Rise

Risks Impacts

Heat stress, cold waves, wild-

fires, reduced arable land

Inland and coastal flooding,

power outages, saline intru-

sion

Flooding, saline intrusion,

coastal erosion

Crop loss, asthma, spread

of pests, vector-borne

disease

Property loss, business

loss and interruption, infra-

structure damage, crop and

marine life loss, disease

Infrastructure loss, property

loss

13

14 15

The Unavoidable Opportunity: Investing in the Growing Market for Climate Resilience Solutions

Page 7 of 25

March 2024

agile healthcare diagnostics all will

be increasingly needed as a result

of rapidly changing environmental

conditions. Representative solutions to

climate impacts are shown in Figure 3

as illustrative examples.

Recognition and experience of climate

risks and impacts is already leading to

increased spending to address specic

climate hazards in the private sector.

Figure 3: Examples of Adaptation Solutions by Sectors and Hazards

(Illustrative, not exhaustive list)

Climate Related

Impact Drivers

Extreme

Heat

Drought

Extreme

Storms

Sea Level

Rise

Sector

Examples of Adaptation Solutions

Climate Adaptation Intelligence Climate Adaptation Products & Services

Agriculture

Real Estate

Water Supply &

Management

Information

Technology

Infrastructure &

Transportation

Energy

Health

Financial

Services

• Climate monitoring and forecasting

• Temperature regulation technologies for livestock

• Remote sensing-based drought monitoring tool

• Crop data and analytics platform with mapping interface

• Satellite imagery for monitoring and impact assess-

ment

• Sea-level processing software

• Water monitoring and modelling (e.g. water resource

mapping)

• Hydrological forecasting system

• Climate risk analytics

• Geospatial solutions

• Intelligent transportation systems to monitor road

conditions, address hazards in real time, moving traffic

away from areas experiencing a natural disaster, point

first responders to identify priority intervention areas

• Artificial intelligence for grid management

• Artificial intelligence for outage management

• Community-level communication systems

• Disease surveillance systems for outbreak detection

• Remote diagnostics

• Rapid diagnostic tests

• Data analytics to better assess borrower repayment

risk

• Biometrics

• Drought tolerant crops

• Cold chain storage

• Irrigation technologies using high-efficiency systems

• Flood mitigation technologies

• Efficient cooling technologies

• Green roofs

• Water storage technologies

• Water preservation technologies; e.g., smart water

meters

• Irrigation technologies

• Early warning systems for extreme events

• Early response systems

• Stormwater management - drainage and conveyance

• Extreme heat/cold resistant paving material

• Wetlands restoration

• Grid hardening technologies

• Weatherization of renewable assets

• Distributed energy systems/community grids

• Vaccines for new diseases

• Drug treatments for new diseases

• Air purification systems

• Climate parametric insurance

• Digital payment systems

• Blockchain

For example, Pacic Gas and Electric

(PG&E), the 10th largest utility in the

United States, increased its wildre

mitigation plan over $1 billion from

the actual cost in 2021 to $5.96 billion

planned for the year 2022.

19

Recent

regulatory actions in the U.S., such as

the Ination Reduction Act, are further

incentivizing investors to allocate

capital toward solutions that combat

climate-related risks.

Global Adaptation &

Resilience Investment

Working Group

Mounting demand for climate resilience technologies and solutions

creates a growth investment opportunity in existing and new

companies that produce those products and services.

3

Companies offering solutions for

climate resilience will benet from

increasing demand to address the

growing risks and impacts from

climate change, with BlackRock already

reporting initial indicators of increasing

demand for such products.

20

Given

this growing demand, the market may

be under-valuing companies that meet

the need for climate solutions, a factor

that BlackRock considers a driver of

investment opportunity.

21

Many of the

technologies and solutions required

to address climate impacts already

exist, as shown in Figure 3, and may be

available in the market today, although

The Unavoidable Opportunity: Investing in the Growing Market for Climate Resilience Solutions

Page 8 of 25

March 2024

Global Adaptation &

Resilience Investment

Working Group

not always identied as “adaptation

solutions.”

In addition to market opportunity,

climate resilience investments can

enhance the returns of decarbonization

investments. For example, hydropower

generation will need to incorporate new

data and analytics about increasing

drought conditions occurring as a

result of climate change. Failure

to incorporate projected drought

has already threatened renewable

hydropower generation in California.

22

Smart grid upgrades to support

intermittent renewable energy will

also have to address new spikes in

demand created by climate-enhanced

heat waves.

23

Climate modelling to

simulate increased wildre risk due to

hotter, drier conditions will be critical

to reducing the risk of wildres caused

by transmission and distribution

powerlines.

24

Supply chains will have to

both reduce their carbon intensity and

address potential disruptions caused by

more frequent and severe hurricanes,

storms, and wildres.

As investors scale capital into

decarbonization, investing in climate

resilience technologies and solutions

can safeguard and support the success

of those investments. Incorporating

climate change assumptions around

changes in wind patterns, cloud

cover, and water levels into renewable

energy projects can future-proof them

against increasing impacts of climate

change. Including sea level rise and

ooding analyses into the design of

energy efcient buildings can make

them better low carbon investments.

Developing climate smart agriculture

that is both less carbon intensive and

more resilient to drought and extreme

weather can generate both greater

food security and better long term

investment performance.

Climate resilience investments can

also help enable further investments

in biodiversity and nature-based

solutions. For example, investments

in climate risk data and analytics can

inform the design projects that support

biodiversity, agriculture and human

health. Geospatial data and imagery

can help to monitor and implement

nature-based solutions. Accurate

forecasts of climate-enhanced ooding,

for example, can help design ood

defenses like mangroves and wetlands

to supplement seawalls and levees.

Natural climate solutions can effectively

and efciently achieve adaptation

goals as well as support mitigation,

biodiversity, and more equitable

community development. Nature

protection and restoration, by far the

largest forms of carbon sequestration,

must be resilient to wildres, droughts,

heatwaves, and longer-term warming to

preserve their mitigation benets.

Finally, climate resilience solutions

can address the most impacted and

vulnerable populations and help

address equity, justice, and gender

considerations. Disadvantaged

populations in both developed and

developing countries have historically

faced higher vulnerability and suffered

the greatest impact from environmental

hazards, and increasingly from

the physical risks and impacts of

climate change. Women and girls

are particularly vulnerable to water

scarcity, agricultural stress, and natural

disasters, all of which are increasing

due to climate change.

25

Even if these

populations do not have the resources

to be direct buyers of these solutions,

they can benet from distribution

and use in their regions. Intelligence

technologies such as satellite imagery,

digital mapping, catastrophe risk

modeling and weather analytics can

provide critical information as systemic

solutions to safeguard and protect

disadvantaged populations in all areas

of the world, e.g. adaptation solutions

The Unavoidable Opportunity: Investing in the Growing Market for Climate Resilience Solutions

Page 9 of 25

March 2024

Spotlight on Emerging Markets – Scope of Opportunity

While no standard denition of emerging markets exists, leading institutional inves-

tors using the MSCI Emerging Markets Index as a benchmark can measure market

exposures for 24 countries in this universe including China, India, and Brazil with as

many as 3,400 issuers in the investment opportunity set.

27

In aggregate, emerging

markets represent 46% of the world’s purchasing power and 34% of global nominal

GDP.

28

Relative to other developing countries,

29

these markets have more mature

capital markets along with supportive government and regulatory structures.

The investment risks pertaining to emerging markets are generally elevated, howev-

er, and not conned to adaptation and resilience companies. Emerging markets un-

derperformed developed markets in the decade between 2011 and 2023, largely due

to lower corporate earnings growth.

30

Both liquidity and access to capital are lower

for emerging markets compared to developed markets.

31

Overall, assets in emerg-

ing markets are perceived as riskier than their counterparts in developed markets, as

quantied in the volatility of returns when comparing the two.

32

Climate change may pose an even greater risk to emerging markets, which tend

to be in the path of climate destruction with lower budgets for safeguards against

these risks. In fact, climate hazards are already affecting these regions - driving

demand for solutions. Investors can lean into this demand, as well as the rising

incomes and economic growth in these regions, while also seeking investments

with decarbonization co-benets. Investors and local communities alike can benet

by driving local resilience, creating markets to sell into, and integrating investments

with decarbonization investments such as distributed energy.

Global Adaptation &

Resilience Investment

Working Group

that support water access and food

security in the face of increasing

drought and food production stress

will also be important to supporting the

most vulnerable across the world.

Some pioneering investors have already

seen these growth opportunities

and put adaptation at the heart of

their investment strategies. The rst

dedicated adaptation and climate

resilience private investment fund,

Lightsmith Climate Resilience Partners

(also known as CRAFT, the Climate

Resilience and Adaptation Finance

and Technology-transfer facility),

reached rst close in 2019, and has

been actively making growth equity

investments in private companies

that support climate resilience. Large

nancial institutions have identied

adaptation strategies within their

dedicated Climate or Impact funds,

which together exceed a billion

dollars.

26

However, at present few

easily investable public market

products exist by which investors can

gain targeted and systematic exposure

to companies that produce solutions for

adaptation and climate resilience.

The Unavoidable Opportunity: Investing in the Growing Market for Climate Resilience Solutions

Page 10 of 25

March 2024

III. Identifying Adaptation

Solutions Companies

Climate resilience investments can be identied by investors.

Since not all companies self-identify

their products and services as

“climate resilience” or “adaptation”

technologies and solutions, there

is need for greater clarity as to the

investible universe for investors to

uncover these growth opportunities. In

order to support investors in identifying

adaptation solutions companies,

GARI has developed a framework that

incorporates existing methodologies

and aligns with ongoing developments

to identify adaptation opportunities

with a range of investment strategies,

including application to listed equities.

Goals of the Framework for

Identication

GARI’s 2024 Climate Resilience

Investments in Solutions Principles

(CRISP) framework is intended to offer

a structured approach for transparently

determining whether a company has

growth potential as an “adaptation play”

based on the technologies, products

and services offered across all asset

classes, sectors, and geographies.

The CRISP framework builds on

existing denitions and approaches

to identifying adaptation companies,

with consistency and alignment with

the EU Sustainable Finance Taxonomy,

Climate Bonds Taxonomy, and the 2020

ASAP Adaptation Solutions Taxonomy.

However, existing taxonomies such

as these, and those proposed by UN

Environment Programme Technology

Needs Assessment (TNA),

33

World

Bank Group,

34

and many others

35

may

be regionally targeted, focused on

Global Adaptation &

Resilience Investment

Working Group

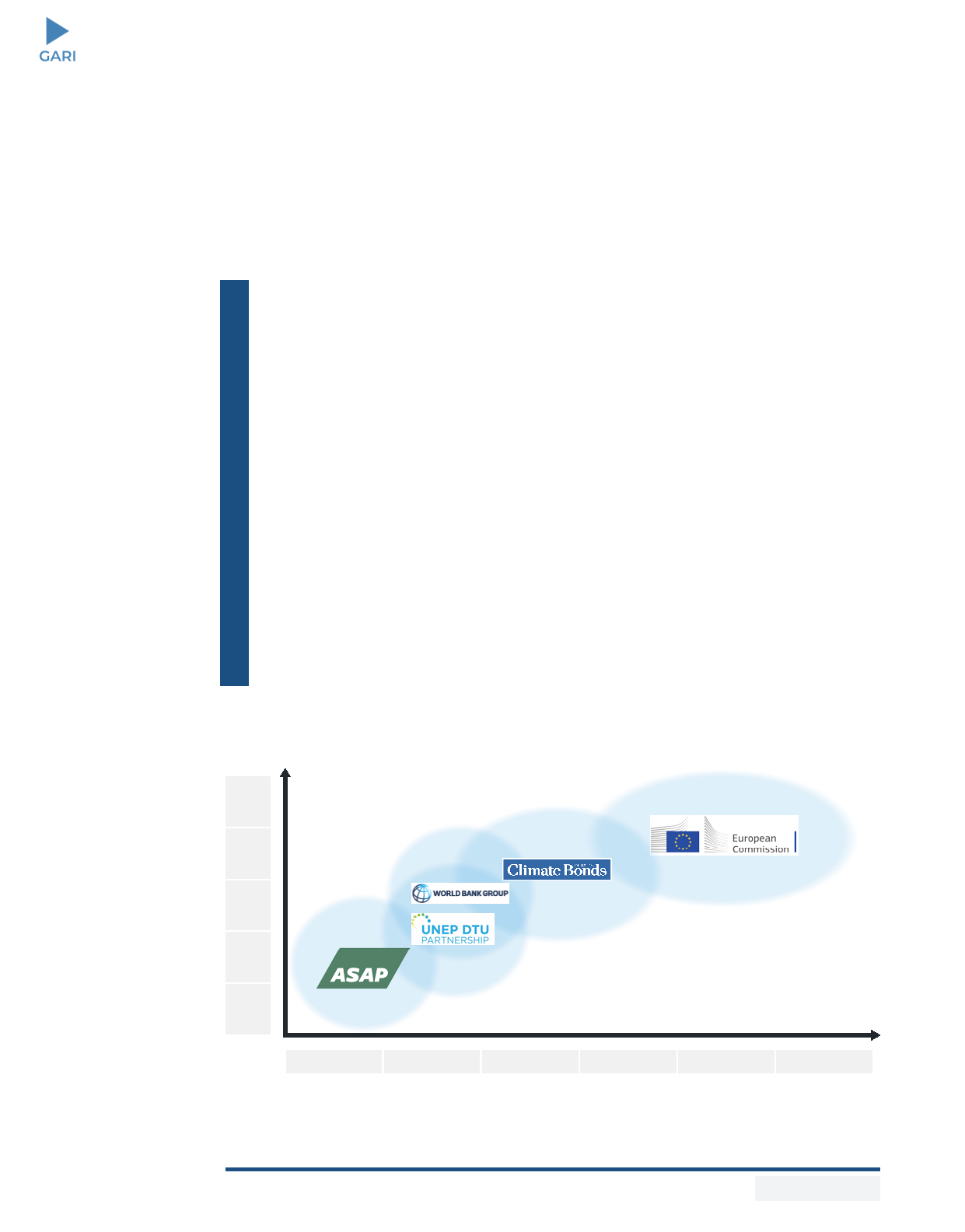

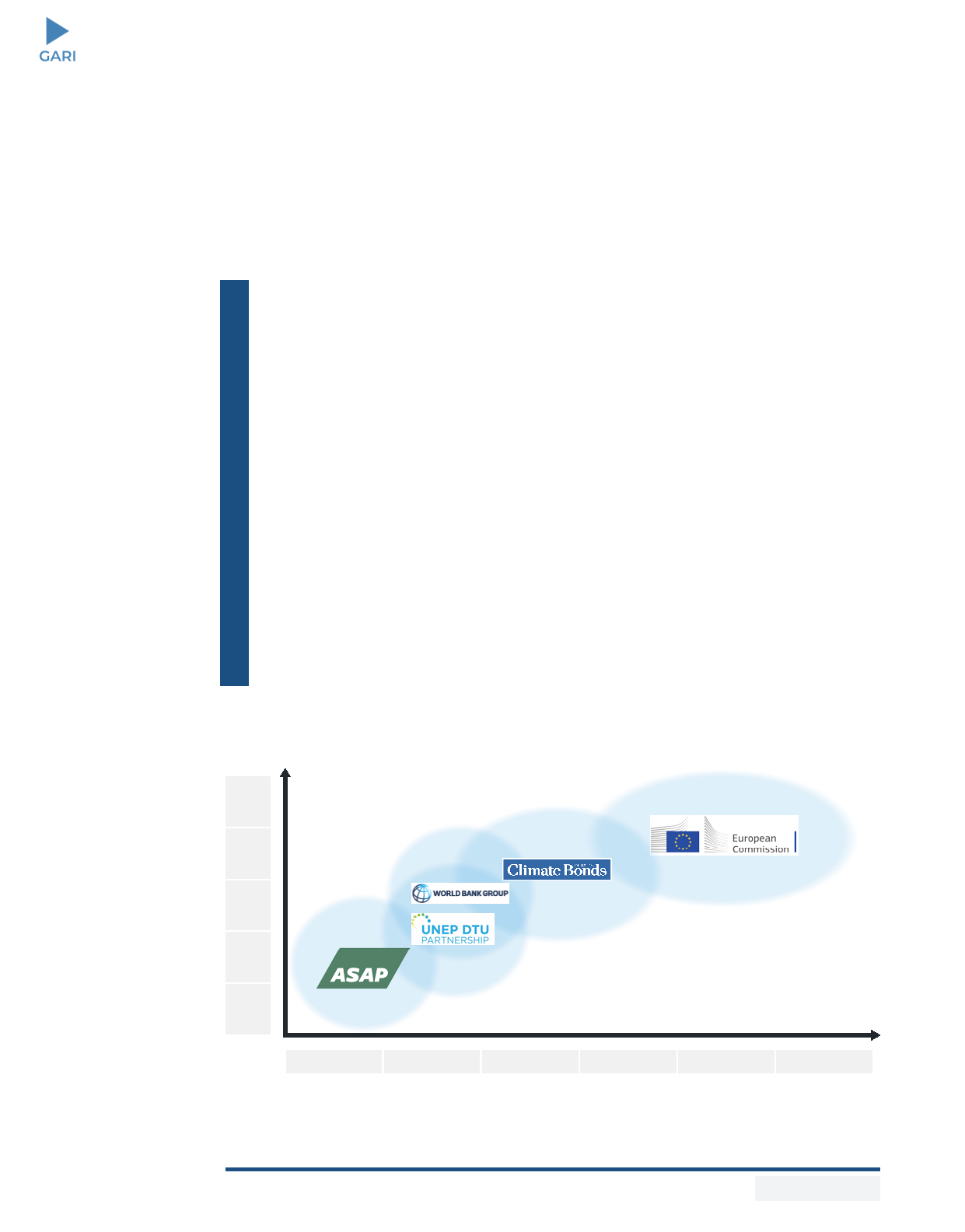

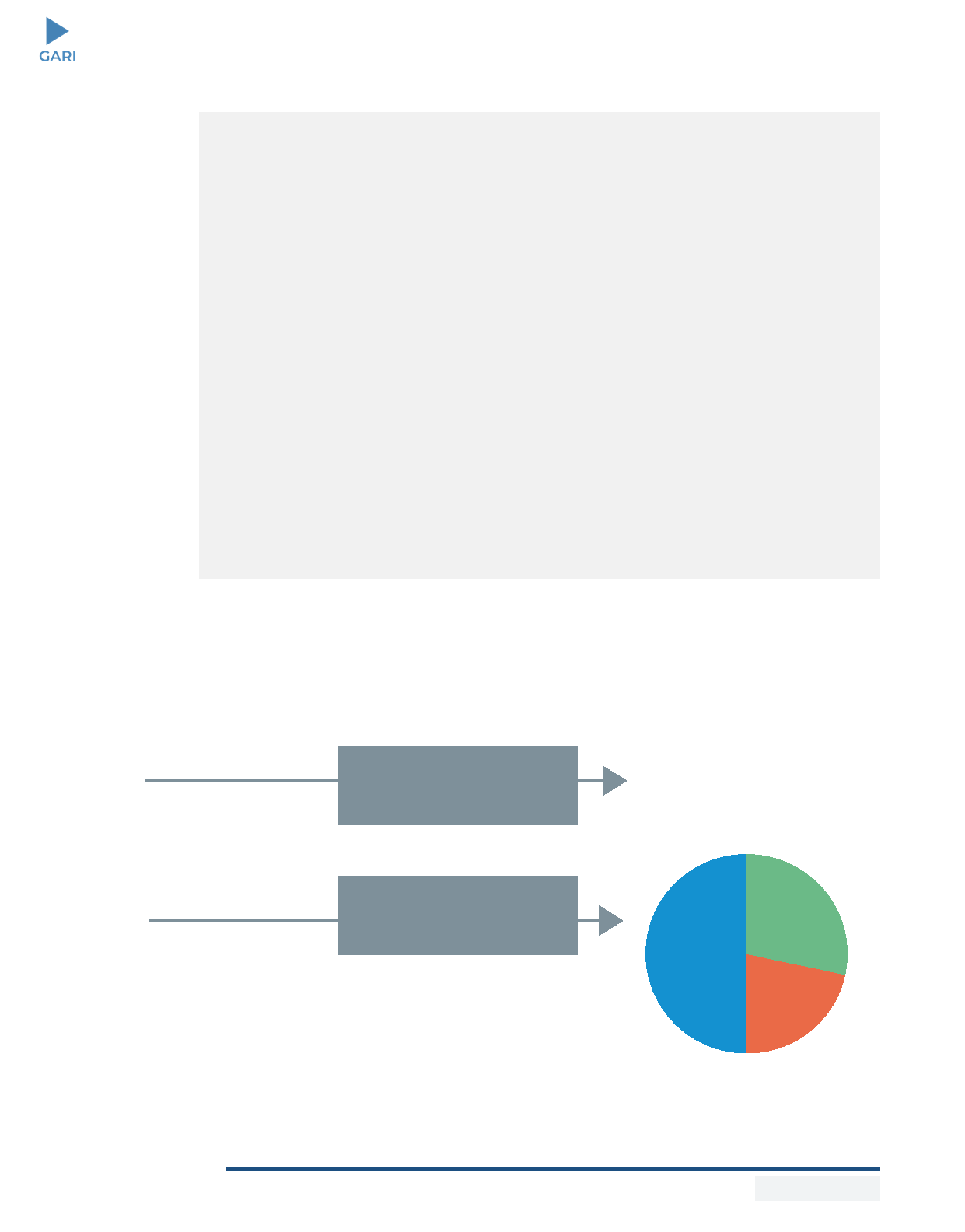

Figure 4: Taxonomies for Resilience Investment

Company Size

Geography

Seed

Stage

Venture

Capital

Project

Finance

Private

Equity

Publicly

Traded

Active

Least Developed

Countries

Developing

Countries

Emerging Markets

Developed Countries Focused Markets All Markets

The CRISP Framework seeks to encompass current

sustainable finance taxonomies to provide a holistic and

inclusive framework for companies in all regions and

growth stages, specifically focused on resilience and

adaptation solutions.

The Unavoidable Opportunity: Investing in the Growing Market for Climate Resilience Solutions

Page 11 of 25

March 2024

needs assessment versus solutions,

or limited to identifying emerging

technologies (see Figure 4). The

CRISP framework is proposed as a

comprehensive approach to address

the current gaps and limitations.

The goal of the framework is to

consistently guide investments

into adaptation and resilience at

various stages and to facilitate the

identication, evaluation, investment,

reporting, and engagement with

companies. Adaptation companies

are part of large and emerging theme,

a hallmark of growth investing.

Facilitating adaptation and resilience as

a growth theme for equity investments

is a key desired outcome of the

identication framework.

Scope of the Framework

The scope of this framework is limited

to companies that provide adaptation

and resilience products and services

to third parties rather than businesses

that are taking measures to make their

operations more internally resilient,

which has become a mainstream

element of risk management.

Principles of the 2024 CRISP

Framework

The 2024 CRISP framework aims to

create an inclusive, exible approach to

identifying potential climate resilience

companies that recognizes both

the development of adaptation and

climate resilience as an emerging

investment theme, and that climate

change risk and impacts will continue

to evolve over time. It is intended

to be applied broadly and does not

prescribe a list of companies, sectors,

requirements nor categorically

exclude types of companies, but

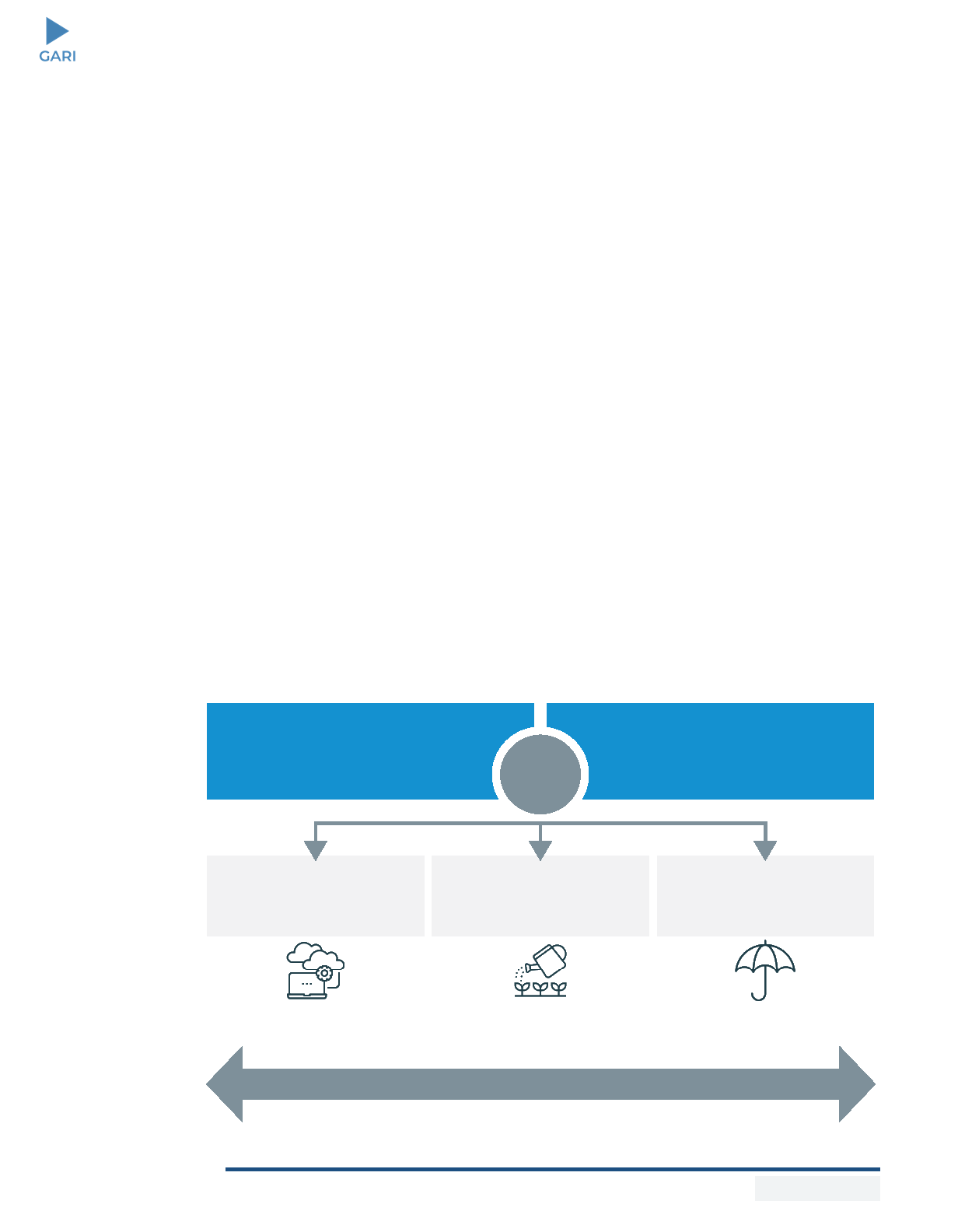

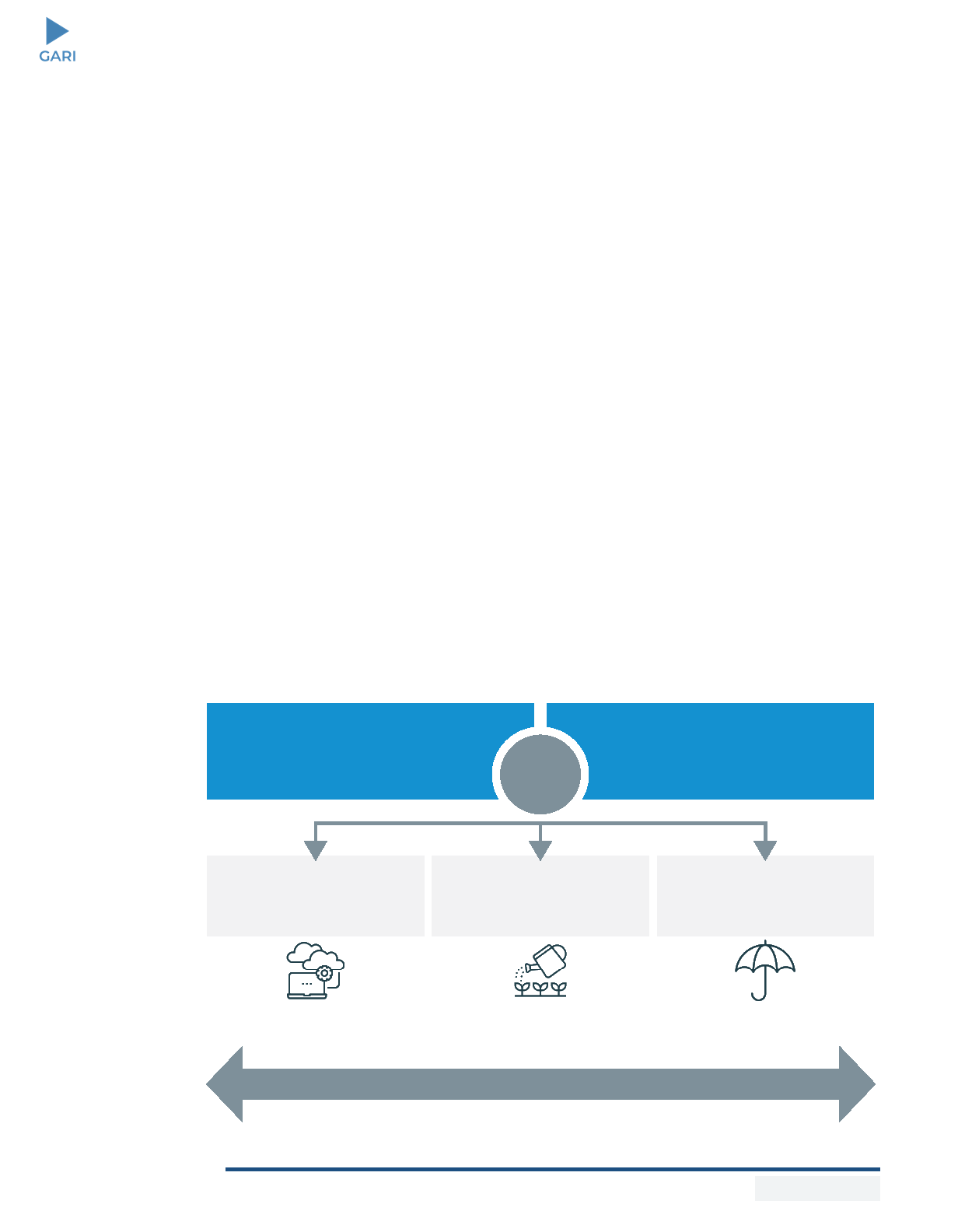

Addressing systemic barriers to adaptation,

including by removing information,

technological, capacity and/or financial

barriers to adaptation by others

AND

/OR

Directly reducing material physical climate

risks or their associated adverse impacts on

other people, nature, physical assets or

other economic activities

Enable to prepare and prevent physical

climate risks by increasing the ability of

people, nature, physical assets or businesses

to understand climate-related risks and

manage them with foresight

Enable to respond to physical climate risks

by increasing the ability of people, nature,

physical assets or businesses to cope and

adjust to adverse conditions

Enable to recover from adverse physical

climate impacts by increasing the ability of

people, nature, physical assets or businesses

to mitigate the adverse impacts of climate

events and ‘build-forward-better’

Before During After

Examples of

Resilience

Solutions

Adaptation

Continuum

Climate information

services

Water-efficient irrigation system

in drought prone rain fed context

Climate parametric

insurance

Figure 5: Description of an Adaptation Solution Company

A Resilience Solutions Company is a company that has a signicant business offering of a technology, product, service and/or practice that

enables others to prepare, prevent, respond to and recover from climate shocks and stresses by:

Global Adaptation &

Resilience Investment

Working Group

The Unavoidable Opportunity: Investing in the Growing Market for Climate Resilience Solutions

Page 12 of 25

March 2024

instead provides illustrative and non-

exhaustive examples. The principles

point towards assessment of the

growth potential of a company, line

of business or product market. Given

that the adaptation market is evolving

with new and unknown impacts, the

framework leaves room for solutions

and technologies yet to be envisioned

and developed and explicitly calls for

periodic reassessment and evaluation.

This framework is intended to be:

• A dynamic and exible tool,

evolving over time along with

existing and emerging international

sustainable nance frameworks.

• Complementary to existing

frameworks, standards, and

regulations with high-level

guidelines for how the framework

and principles can be applied in

different contexts.

• Inclusive, without prescriptive pre-

dened lists of solutions because

the range of technologies, products

and services are wide ranging and

fast evolving.

• Agnostic to growth stage, sector,

and geography of adaptation

solutions to allow for both new

innovative solutions and business

models as well as the uptake and

transferring of existing ones to new

contexts.

Identication Framework

Fundamentally, an adaptation solutions

company has a signicant business line

in a technology, product or service that

prevents or reduces the impacts before,

during or after a climate hazard. Figure

5 provides a more detailed description

of a climate adaptation solutions

company and the elements to consider

from the new 2024 CRISP framework.

Adaptation solutions are wide-ranging

across physical risks and impacts and

across multiple sectors and already

offered by many large, publicly traded

companies. Identifying opportunities by

sector requires understanding the range

of impacts, and solutions existing or in

development.

Considerations for Listed Equity

Investors

Investors in listed equities will have

special considerations when pursuing

adaptation as a growth theme for their

portfolios.

• Engagement – Many adaptation

companies can be identied

through analytical methods using

publicly available information

such as earnings calls, investor

presentations, sustainability reports,

and annual reports. However,

increased insights gained from

direct engagement with investees

can be important to understanding

the growth strategy for prospective

adaptation solutions including the

company’s view of market size,

competitive position, and unique

value proposition for realizing

growth potential. The depth of

assessment, information available

and degree of active engagement

all can factor into identifying

adaptation companies and help

them, their supply chains and their

customers see their role in this

market.

• Thresholds – For large companies

involved in a range of activities,

the threshold of revenue coming

from adaptation products or

services within a business is

key consideration. Investors

can consider both current and

potential future value of revenue

derived from the resilient product

or service business line based on

the broader corporate strategy

and growth potential. For example,

even if the current level of revenue

or percentage of assets under

Global Adaptation &

Resilience Investment

Working Group

The Unavoidable Opportunity: Investing in the Growing Market for Climate Resilience Solutions

Page 13 of 25

March 2024

management is minimal, this

might be offset by future plans,

competitive positioning, research

and development budgets. A

company’s patent portfolio may

also be used as leading indicator

of future growth potential. Where

further engagement is possible,

investors can incorporate deeper

assessments of market capacity,

competitive position, and unique

product/market t in making their

determination.

• Consideration of net carbon impact

of solutions – The framework

suggests that adaptation solutions

should be sensitive to minimizing

net carbon impacts. However,

the net impact may be difcult to

assess, and complete data may

not be available. Engagement with

investees at every stage of the

investment process from screening

and due diligence to investment and

monitoring will be helpful to this

determination.

Example 1

Technology Company, New York Stock Exchange

$122 billion publicly traded multinational conglomerate offering products and

services related to building and industrial automation, energy solutions, and

aerospace technologies. Adaptation solutions include air purication systems, air

quality monitoring devices, refrigerants, power grid resiliency, and Internet of Things

urban communication networks. We estimate 18% of the company’s 2022 revenue

is from adaptation and resilience products.

Example 2

Pharmaceuticals Company, New York Stock Exchange

$76.6 billion publicly traded multinational pharmaceutical and biotechnology

company. Adaptation solutions include medication and research and development

on new vaccines, drugs and treatments to prevent and combat the spread of known

and emerging diseases that warming temperatures and extreme weather events

may exacerbate. Also invests in respiratory health medication to mitigate the

impact of air pollution. The company does not delineate product-level revenues. We

estimate approximately 20% of its total 2022 revenue is from products that alleviate

or combat climate-induced diseases and conditions.

Example 3

Engineering Company, Tokyo Stock Exchange

$3.5 billion publicly traded global engineering and technology products company.

Business segments include manufacturing of semiconductors, automotive

parts, medical devices and environmental monitoring and measuring equipment.

Adaptation solutions include water and air quality measuring devices. An estimated

2% of the company’s 2022 revenue is from adaptation and resilience products.

Global Adaptation &

Resilience Investment

Working Group

The Unavoidable Opportunity: Investing in the Growing Market for Climate Resilience Solutions

Page 14 of 25

March 2024

Spotlight on Emerging Markets – Identifying Companies

The consideration set of emerging market companies may include both those

domiciled in emerging markets, and those domiciled in developed markets that

may be selling into emerging markets or have foreign subsidiaries based in

emerging markets to better serve local needs.

Starting with this broad universe of companies, investors can apply GARI’s 2024

CRISP framework to identify companies that offer relevant adaptation solutions,

and may loosen or tighten criteria to expand or focus the results. These criteria

may include thresholds for the amount of revenue from specic geographies,

especially for companies not domiciled but selling into emerging markets.

Adaptation solutions are driven by local context, especially in emerging mar-

kets. Investors need to understand geographical, climatic, and social specics

such as exposure to physical risks, infrastructure gaps, and population trends.

Priority sectors for adaptation in these markets may include agriculture, water,

resilient infrastructure, and health due to the higher economic dependence in

emerging markets on natural resource management. For example, solutions

may include irrigation technologies, water metering, and disease prevention

drugs. In addition to these sectors, intelligence, monitoring, digital nance, and

warning systems are all in demand.

Global Adaptation &

Resilience Investment

Working Group

The Unavoidable Opportunity: Investing in the Growing Market for Climate Resilience Solutions

Page 15 of 25

March 2024

IV. Approaches to Portfolio

Construction for Thematic

Exposure

Armed with an understanding of which sectors and technologies are most

relevant for the resilience solutions thesis, and a framework for identifying

which companies are in the business of resilience, how can investors

identify the specic companies in the investable universe? This section

describes the results of an analysis undertaken by the MSCI Sustainability

Institute.

36

It focuses on public markets, using over 9,000 constituents of the

MSCI ACWI (All Country World Index) IMI (Investible Markets Index)

37

as of

December 2021, as the starting universe of potential companies.

38

Pilot Analysis Methodology

The approach to developing a universe

of “adaptation solutions” companies

started with identifying climate hazards

and impacts, and then identifying

the current solutions available based

on various adaptation and resilience

taxonomies and frameworks.

39

Companies domiciled across 47

countries, including all major stock

exchanges were considered in the

analysis. An understanding of existing

products and services was imperative

to ultimately identify their providers.

Various methods were tested to

determine the methodology best suited

for this exploratory exercise, including

the use of natural language processing

(NLP) and articial intelligence (AI).

Ultimately, the method used employed a

Large Language Model (LLM) to identify

companies that offer products and

services related to climate adaptation

or resilience. An LLM’s ability to

contextually understand text was an

advantage over prescriptive approaches

that use key words or phrase searching.

Company descriptions from annual

reports were used to determine if the

product offering may be classied as

an adaptation and resilience solution.

The methodology employed the LLM

to classify the companies based on

a set of questions to determine if the

company’s offering was an adaptation

solution. Preliminary analysis was

run on smaller sets of companies,

with manual validation determining

the quality of answers. Correct

classications were identied, and fed

to the LLM to be used as prototype

responses.

The analysis did not involve any direct

interaction with the companies in

the analytical set but required high

levels of manual validation with sector

analysts. The process was an iterative,

discovery-based approach to rene the

methodology, in order to reasonably

discern the nuance and complexity of

climate adaptation solutions offered by

publicly listed companies.

First Cut Identication of

Investible Universe

Initial analysis suggests that over 800

publicly traded companies exist that

could potentially serve as an investible

universe of companies for a variety of

public markets investment approaches

(see Figure 6). This represents about

11% of the overall MSCI ACWI index,

by number of issuers, after screening

out companies that did not pass the

Global Adaptation &

Resilience Investment

Working Group

The Unavoidable Opportunity: Investing in the Growing Market for Climate Resilience Solutions

Page 16 of 25

March 2024

Products and technologies can have more than one use case. The end-use may dene

the service as one that enables adaptation or, in extreme cases, contributes adversely to

climate change. As a hypothetical example for why investors should pay special attention

to multi-use products: pipes have end-uses for storm water drainage or irrigation – a

critical product to improve adaptation and resilience in key markets; pipes can also have

end-use for oil eld work.

Producers and sellers of such multi-use products are included the rst cut universe of

adaptation-enabling companies. The classication and ultimate inclusion of such multi-use

products in an adaptation-enabling portfolio would require the portfolio manager to better

understand the use cases or develop guidelines to guardrail investment decisions.

How investors treat such dual-use products has well-established precedents in responsible

and sustainable investing. For example, in the context of screening for weapons, investors

confront the challenge of dual-use items, whereby goods and services, such as aluminum

pipes and navigation technologies, can be used for both civilian and military applications.

Different investment institutions have different investment policies and statutory

obligations. Additional data that can indicate the degree of involvement in the target

activity, such as direct provision of goods and services or indirect contribution through the

value chain (e.g. distributor or retailer), may be applied such that each investor can best

match the level of involvement with the stringency of its policy.

40

Global Adaptation &

Resilience Investment

Working Group

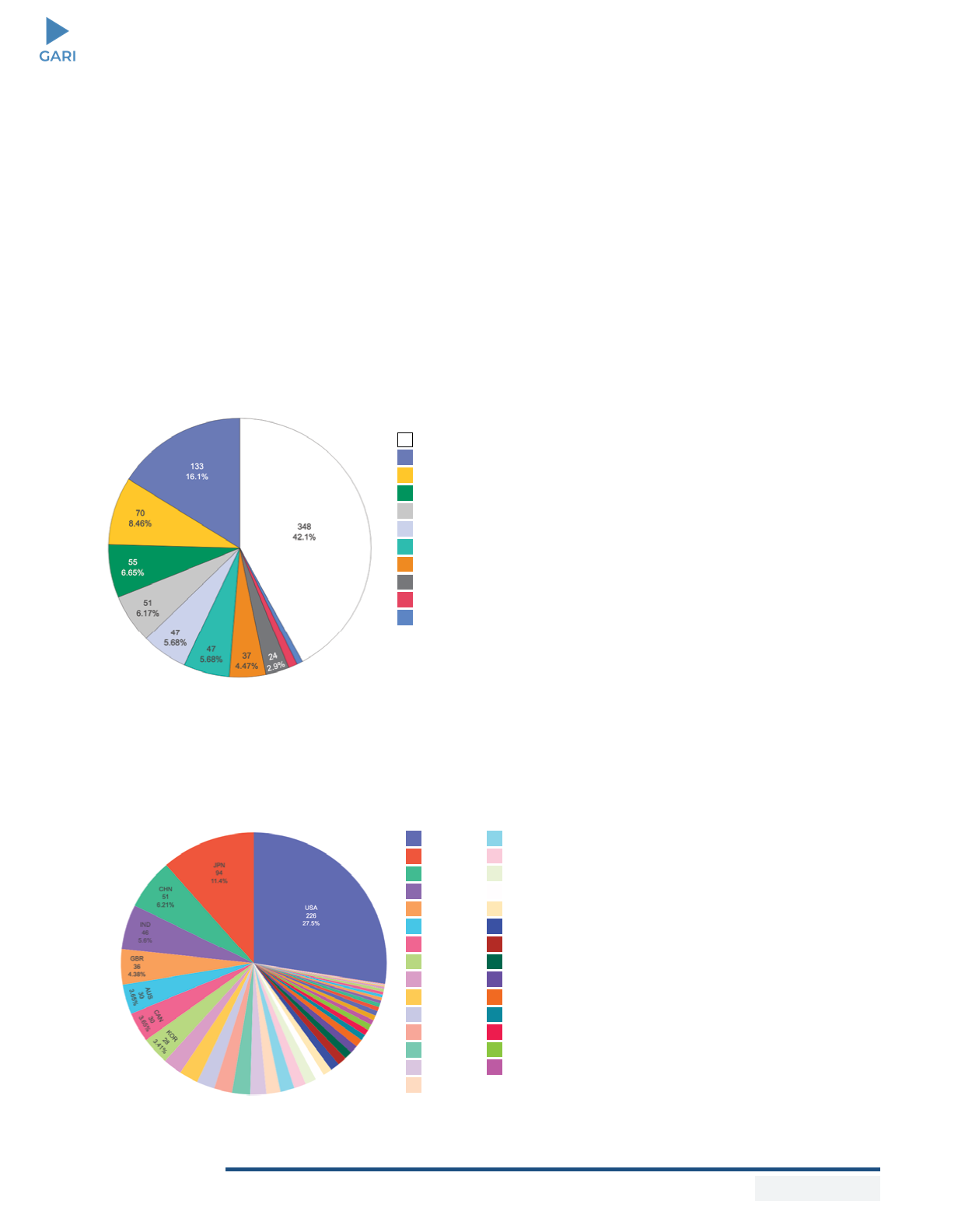

Figure 6: First Cut of Resilience Company Universe

*ACWI IMI Index as of Dec 2021. This sample set already excludes companies agged under MSCI’s

EU Do No Signicant Harm (DNSH) criteria.

7,601*

47

ACWI IMI Index

Companies

Markets covering

large, mid and small

cap companies

99% of the global equity

investment opportunity set

23 Developed Markets (DM)

24 Emerging Markets (EM)

Small Cap

294

50%

Large Cap

127

21.6%

Mid Cap

167

28.4%

~827

A&R Companies

Multi-Use Products in the Context of Adaptation & Resilience

The Unavoidable Opportunity: Investing in the Growing Market for Climate Resilience Solutions

Page 17 of 25

March 2024

JPN

USA

IND

CHN

AUS

GBR

KOR

CAN

TWN

FRA

SGP

DEU

SWE

SAU

HKG

THA

CHE

IDN

BRA

NOR

MYS

DNK

ESP

ISR

ZAF

NLD

AUT

ITA

MEX

Figure 8: Resilience Companies by Country

Distribution of Resilience Companies per Country

assessing the investment opportunity

set in listed equities. The initial universe

of adaptation companies identied, and

the process for classication, lays the

groundwork to identify companies that

provide exposure to climate resilience

solutions via both fundamental,

quantitative, and qualitative methods.

Further analysis indicates that

industrials and materials Global

Industrial Classication Standard

(GICS) sectors constituted

approximately 58% of the identied

set of companies, as shown in

Figure 7.

42

Compared to the sector

distribution of the MSCI ACWI

IMI Index, these two sectors are

over-represented in the rst-cut

adaptation universe (based on the

number of companies), driven by

the focus on infrastructure and

materials inputs for adaptation and

resilience products.

The analysis also indicated that

two-thirds of resilience companies

are domiciled in developed markets,

as shown in Figure 8. These

590 companies represent a little

over 11% of the total universe of

developed markets included in the

MSCI ACWI IMI Index.

Approaches to Portfolio

Construction

Taking this framework for

identifying adaptation companies,

investors can apply these insights

in a range of ways to their

investment strategies. However,

gaining exposure to the adaptation

theme in portfolio construction

is nuanced and does not apply

consistently to all strategies. This

section provides specic insights

and considerations pertaining to

opportunities and limitations for

a range of investment strategies

including concentrated thematic to

Materials

Industrials

Information Technology

Consumer Discretionary

Real Estate

Financials

Consumer Staples

Utilities

Energy

Communication Services

Health Care

Figure 7: Resilience Companies by Sector - First Cut

Resilience Companies by GICS Sector

Global Adaptation &

Resilience Investment

Working Group

European Union “Do No Signicant

Harm” lter, as determined by MSCI

ESG Research’s EU Taxonomy

methodology.

41

The data analysis is limited as rst cut

ndings, yet the demonstration case

provides a market-based approach to

The Unavoidable Opportunity: Investing in the Growing Market for Climate Resilience Solutions

Page 18 of 25

March 2024

companies are more likely to be driven

by assessment of the underlying

business models and outlook for

growth, rather than from current

revenues.

Systematic investing, driven purely

on quantitative signals, would be

difcult to implement at this stage

of development because insufcient

data and contingency of any

adaptations solutions on the market

context presents challenges to rules-

driven processes. Likewise, passive

investment strategies for resilience are

not yet in sight, due to these needs for

fundamental analysis, high engagement

and focused investments.

For all equity investors into adaptation

themes, seeking alpha while controlling

risk remains a critical consideration.

Hence, investors may lean towards

sector allocations that hew to standard

benchmarks, rather than a highly

skewed sector distribution.

Fixed income is outside the scope of

this paper, but we note that it is an

important opportunity for adaptation

investing as well. These investments

are more likely to lean into project

nance or corporate bonds, and may

benet from some of the existing

frameworks such as the Climate Bonds

Taxonomy

43

for identifying solutions

and considerations for portfolios.

Potential Areas of Expansion

This initial analysis is just that – a

starting point for consideration

by investors. Other data sources

for analysis could include investor

presentations, corporate websites,

earnings call transcripts, ESG

reports and other sustainability and

impact reports. Data from company

reports may range from total market

capitalization to revenue by product

line, geographies and research and

development budgets.

broad tilts; fundamental and systematic;

equities and xed income; public and

private markets.

For example, concentrated strategies

may be too limited for a specic

adaptation growth theme in public

markets. Listed equities are unlikely to

be “pure play” adaptation investments

at this stage due to the size of the

companies on major stock exchanges.

Therefore, attempts to identify pure

play adaptation companies would

dramatically narrow the opportunity

set for investment. Over time, large,

diversied companies may opt to

spin-out adaptation-specic business

units, similar to how some energy and

industrial companies have spun out

businesses targeting climate mitigation.

Broad tilt strategies may be better

suited to incorporate companies

with some adaptation business

opportunities. Here, assumptions on

the signicance and growth potential

of adaptation business lines, relative

to other lines of business, are crucial

to assessing the potential exposure of

the portfolio to the target adaptation

themes of interest and their nancial

impact. Investors can use their own

analysis to set thresholds for relevance

of the theme to potential impact on

stock price or corporate strategy. In

other words, each investor would need

to express a view on where to draw

the line for the level or percentage of

revenue or other metrics to qualify as

having exposure to the target theme of

interest.

Similar to other emerging growth areas,

fundamental analysis is important to

evaluating investments in this area.

Investors can determine where they

see growth opportunities, where

value is underappreciated and alpha

undiscovered in companies offering

adaptation solutions. High conviction

for investments in adaptation

Global Adaptation &

Resilience Investment

Working Group

The Unavoidable Opportunity: Investing in the Growing Market for Climate Resilience Solutions

Page 19 of 25

March 2024

Global Adaptation &

Resilience Investment

Working Group

The Unavoidable Opportunity: Investing in the Growing Market for Climate Resilience Solutions

Page 20 of 25

March 2024

Spotlight on Emerging Markets – Portfolio Construction

Equities in emerging markets have potential for tremendous scale, with their

share of the global equity market projected to eclipse developed countries in

the coming years.

44

Major investment houses such as Wellington, JPMorgan

Chase, and Nuveen feature both emerging markets funds and climate funds.

Impact investors such as Sarona and Lightsmith are on the forefront of invest-

ing in climate solutions specically in emerging markets. A growth investment

theme around adaptation and resilience in emerging markets represents a new

universe of investments that is already gaining traction.

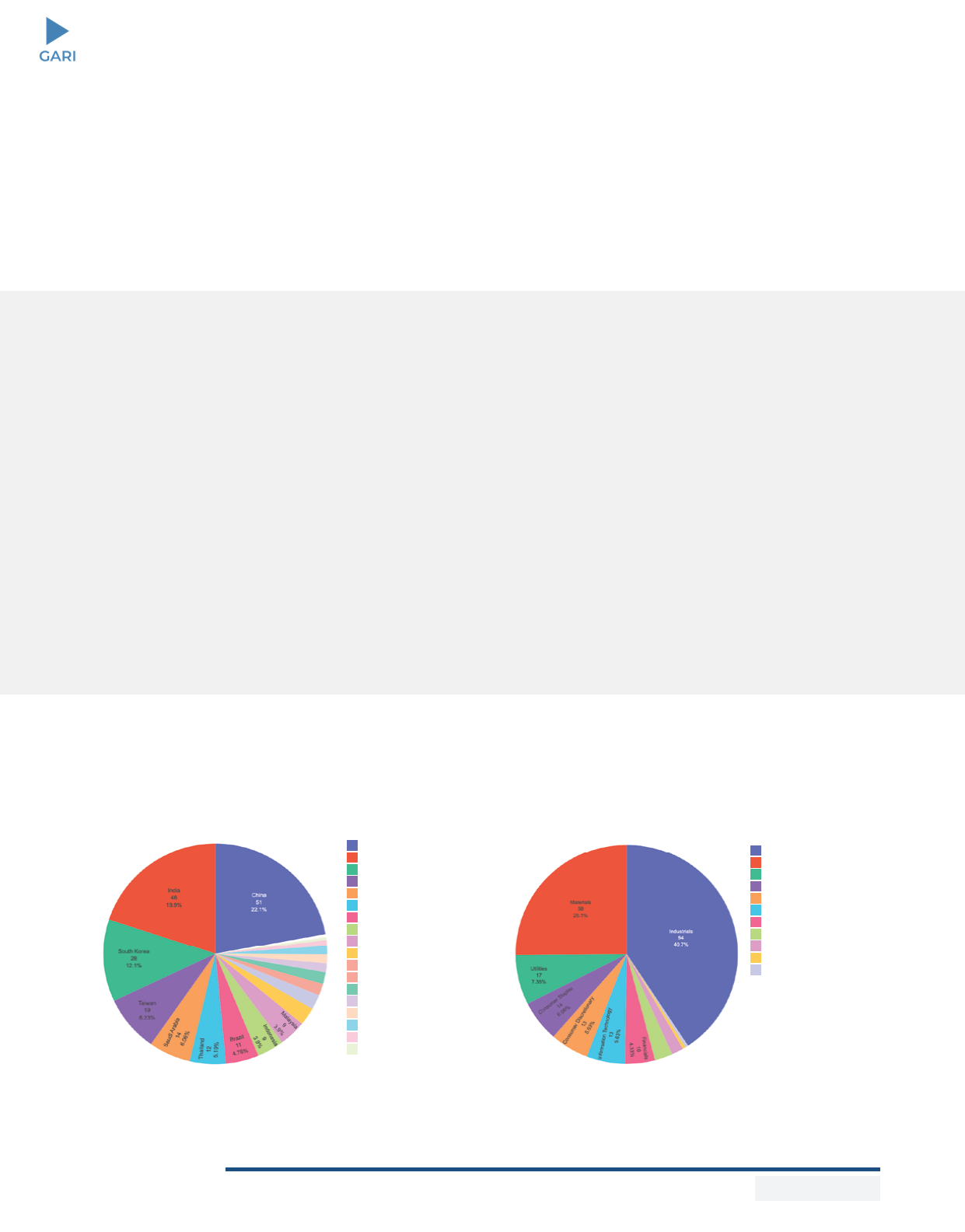

Mapping of adaptation solutions by MSCI identied at least 231 emerging

market-domiciled publicly-traded companies offering adaptation solutions in

these markets – a number expected to grow as demand for solutions acceler-

ates. This group represents 9.5% of the total emerging market companies in the

MSCI ACWI IMI Index. Details of where the companies are based and a distribu-

tion of the sectors represented are provided in Figures 9 and 10.

adaptation technologies, competitive

positioning for adaptation solutions,

t within overall company strategy,

secular trends that are creating growth

opportunities and how these companies

are positioned to take advantage of

growing needs and demands.

Active portfolio managers interested

in opportunities with this investment

theme should bring insight into

their investment decisions where

possible with investee engagement

to deepen their understanding of

the potential market size for new

Materials

Industrials

Consumer Staples

Utilities

Information Technology

Consumer Discretionary

Energy

Financials

Real Estate

Communication Services

Health Care

Figure 10: Emerging Markets

Resilience Companies by Sector

Source: MSCI Sustainability Institute

India

China

Taiwan

South Korea

Thailand

Saudi Arabia

Indonesia

Brazil

Malaysia

South Africa

Philippines

Mexico

Kuwait

Turkey

United Arab Emeirates

Poland

Egypt

Chile

Qatar

Figure 9: Emerging Markets Resilience

Companies by Nation

Source: MSCI Sustainability Institute

V. Conclusion

Climate resilience investments can be made at scale,

including in publicly traded companies.

Climate resilience is an attractive growth theme investment opportunity, with

investment prospects on par and in tandem with decarbonization. Investors

have a signicant opportunity to be on the forefront of investing in adaptation,

anticipating market needs, fueling demand for solutions and enabling

readiness for the future across markets, sectors and portfolios. Relevant and

attractive companies in this space can be identied through market-standard

analysis, identifying potential for investment at scale that fall within the

framework of the adaptation thesis. An explicit focus on “climate resilience” as

a growth investment theme capitalizes on rising demand for critical solutions

to current and future climate impacts that are certain to occur. Investments

in adaptation are growing, although remain nascent compared to the market

potential and overall global needs. Climate resilience investments are ready to

be made at scale in publicly traded companies.

This framework can help facilitate investment in adaptation solutions offered

by large companies, and offers a pathway to deploying large-scale allocations

at pension funds, actively managed funds, index funds or other public markets

investment strategies.

We invite you to access the new 2024 Climate Resilience Investments in

Solutions Principles (CRISP) on the GARI website and carefully consider

opportunities in this market. This is a roadmap for investors to identify

solutions and invest.

Global Adaptation &

Resilience Investment

Working Group

The Unavoidable Opportunity: Investing in the Growing Market for Climate Resilience Solutions

Page 21 of 25

March 2024

VI. About

Bezos Earth Fund is transforming the ght against climate change with the

largest ever philanthropic commitment to climate and nature protection. The

fund is investing $10 billion to protect nature and drive systems-level change,

creating a just transition to a low-carbon economy. By providing funding and

expertise, the fund partners with organizations to accelerate innovation, break

down barriers to success and create a more equitable and sustainable world.

ClimateWorks Foundation is a global platform for philanthropy to innovate

and scale high-impact climate solutions that benet people and the planet. We

deliver global programs and services that equip philanthropy with the knowl-

edge, networks, and solutions to drive climate progress for a more sustainable

and equitable future. Since 2008, ClimateWorks has granted over $1.8 billion to

more than 850 grantees in over 50 countries.

Global Adaptation and Resilience Investment Group, Inc. (GARI) is a

private sector, private investor-led initiative that was announced at Paris COP21

in conjunction with the UN Secretary General’s Climate Resilience Initiative.

The working group brings together private and public sector investors, bankers,

lenders and other stakeholders to discuss critical issues at the intersection of

climate adaptation and resilience and investment with the objective of helping

to assess, mobilize and catalyze action and investment. GARI aims to provide

education, research, and resources to build awareness and capacity in the pri-

vate sector towards the mission of catalyzing investment in resilience. To learn

more, visit garigroup.com.

MSCI Sustainability Institute has a mission to drive progress by capital

markets to create sustainable value and tackle global challenges such as

climate change. Our goal is to align data, analysis, policy, and action. We do

this by drawing upon MSCI’s experience and expertise as a leading provider of

sustainability data and metrics to the investment industry to spur collaboration

across nance, academia, business, government, and civil society. For more

information and to engage with us, visit msci-institute.com.

The Lightsmith Group is a sustainable private equity rm that invests in com-

panies that address critical societal needs. Lightsmith invests in growth-stage

companies providing technology-enabled business services and solutions in the

areas of energy, water, food and agriculture, and climate resilience. For more

information on The Lightsmith Group, please see: lightsmithgp.com.

Global Adaptation &

Resilience Investment

Working Group

The Unavoidable Opportunity: Investing in the Growing Market for Climate Resilience Solutions

Page 22 of 25

March 2024

VI. References

The Unavoidable Opportunity: Investing in the Growing Market for Climate Resilience Solutions

Page 23 of 25

March 2024

2

https://www.goldmansachs.com/intelligence/pages/emerging-stock-markets-projected-to-overtake-the-us-by-2030.html

3

Ibid.

4

https://wmo.int/media/news/economic-costs-of-weather-related-disasters-soars-early-warnings-save-lives

5

https://www.aon.com/weather-climate-catastrophe/index.aspx

6

https://www.whitehouse.gov/wp-content/uploads/2022/04/OMB_Climate_Risk_Exposure_2022.pdf

7

https://www.nrdc.org/stories/ipcc-climate-change-reports-why-they-matter-everyone-planet?gclid=Cj0KCQjw7JOpBhCfARI-

sAL3bobdcV5cHMADgOKMhgignUm6VinLZPaHKHFIDknmTB5WdHbfcRc5jdR4aAjdzEALw_wcB#sec-latest

8

https://www.climatepolicyinitiative.org/publication/global-landscape-of-climate-nance-2023/

9

Ibid.

10

Ibid.

11

https://www.ncei.noaa.gov/access/billions/time-series

12

UNEP Adaptation Gap Report 2023

13

https://www.un.org/en/climatechange/science/causes-effects-climate-change

14

https://www.ipcc.ch/report/ar6/syr/downloads/report/IPCC_AR6_SYR_SPM.pdf

15

Ibid.

16

https://www.soa.org/globalassets/assets/les/resources/research-report/2019/12th-emerging-risk-survey.pdf

17

https://www.cdp.net/en/articles/media/worlds-biggest-companies-face-1-trillion-in-climate-change-risks

18

https://www.cdp.net/en/research/global-reports/global-climate-change-report-2018#83de191c-

12c3c109006c4593128d8bb612c3c109006c4593128d8bb6

19

https://www.pge.com/pge_global/common/pdfs/safety/emergency-preparedness/natural-disaster/wildres/wildre-miti-

gation-plan/2022-Wildre-Safety-Plan-Update.pdf

20

https://www.blackrock.com/corporate/literature/whitepaper/bii-megaforces-december-2023.pdf

21

https://www.blackrock.com/corporate/literature/whitepaper/bii-megaforces-december-2023.pdf

22

https://www.energy.ca.gov/sites/default/les/2019-06/Californias_Drought_Impact_on_Hydroelectricity_FS.pdf

23

https://www.eia.gov/todayinenergy/detail.php?id=56920

24

https://energycentral.com/news/maui-re-will-reshape-hawaiian-electric

25

https://www.state.gov/reports/united-states-strategy-to-respond-to-the-effects-of-climate-change-on-women-2023/

26

Examples: JPMorgan Chase, Nuveen, Wellington

27

https://www.msci.com/documents/10199/97e25eb7-9bd0-4204-bea9-077095acf1d3

1

https://www.msci.com/documents/10199/c0db0a48-01f2-4ba9-ad01-226fd5678111

28

https://www.imf.org/external/pubs/ft/fandd/2021/06/the-future-of-emerging-markets-duttagupta-and-pazarbasioglu.htm

29

Please see MSCI’s classication criteria and the current list of countries classied as Frontier Markets, versus Emerging

Markets: Market Classication - MSCI

30

https://www.alliancebernstein.com/corporate/en/insights/investment-insights/dont-look-back-the-next-emerging-market-

decade-will-be-different.html

31

https://www.ssga.com/library-content/pdfs/insights/building-an-optimal-em-portfolio.pdf

32

https://www.temit.co.uk/resources/education-how-to-guides/how-risky-are-emerging-markets

33

https://tech-action.unepccc.org/wp-content/uploads/sites/2/2021/04/report-on-taxonomy-of-climate-change-adapta-

tion-technology-including-factsheets-nalbrief-tna-adaptation-taxonomy.pdf

34

https://documents1.worldbank.org/curated/en/757291604041567018/pdf/Resilient-Industries-in-Japan-Lessons-Learned-

in-Japan-on-Enhancing-Competitive-Industries-in-the-Face-of-Disasters-Caused-by-Natural-Hazards.pdf

35

https://www.globalresiliencepartnership.org/wp-content/uploads/2023/12/from-risk-to-reward-report.pdf

36

https://www.msci-institute.com/

The Unavoidable Opportunity: Investing in the Growing Market for Climate Resilience Solutions

Page 24 of 25

March 2024

37

The MSCI ACWI Investable Market Index (IMI) captures large, mid, and small cap representation across 23 Developed

Markets (DM) and 24 Emerging Markets (EM) countries. With 9,084 constituents, the index is comprehensive, covering ap-

proximately 99% of the global equity investment opportunity set. For the full list of DM and EM countries, please see https://

www.msci.com/documents/10199/4211cc4b-453d-4b0a-a6a7-51d36472a703

38

https://www.msci.com/documents/10199/4211cc4b-453d-4b0a-a6a7-51d36472a703

39

The list of literature reviewed included the EU Taxonomy, UNEP TNA, ASAP Adaptation Solutions Taxonomy, CBI Taxono-

my, GTC UDP Brief: Taxonomy of Climate Change Adaptation

40

For an example of how investors can treat dual-use products, please see MSCI ESG Business

Involvement Screening Research. Available at https://www.msci.com/documents/1296102/10259127/MSCI+ESG+BISR_

Methodology+Guidebook.pdf

41

For details of MSCI’s EU Taxonomy Do No Signicant Harm (DNSH), please see Sustainable Finance FAQs | December

2021. Available at: https://www.msci.com/documents/1296102/21626434/Sustainable-Finance-FAQ.pdf

42

GICS® is an industry analysis framework that helps investors understand the key business activities for companies

around the world. MSCI and S&P Dow Jones Indices developed this classication standard to provide investors with consis-

tent and exhaustive industry denitions.

43

https://www.climatebonds.net/les/les/CBI_Taxonomy_Jan2021.pdf

44

https://www.goldmansachs.com/intelligence/pages/emerging-stock-markets-projected-to-overtake-the-us-by-2030.html

Global Adaptation &

Resilience Investment

Working Group

Disclaimer

This paper is not intended to reect a comprehensive view of adaptation and

resilience investment landscape, nor to recommend specic solutions, but

rather to serve as content and context for other discussions in this emerging

area of investment.

The data provided in this report were prepared by members of the Global

Adaptation & Resilience Investment Working Group (GARI). Publications of

GARI are for information purposes only. The information contained in this

publication has been obtained from sources that GARI believes to be reliable,

but no representation or warranty, express or implied, is made as to the ac-

curacy, completeness, reliability or timeliness of any of the content or infor-

mation contained herein. As such, the information is provided ‘as-is,’ ‘with all

faults’ and ‘as available.’ The opinions and views expressed in this publication

are those of GARI and are subject to change without notice, and GARI has no

obligation to update the information contained in this publication. Further,

neither GARI nor its participants or agents shall be held liable for any improper

or incorrect use of the information described and/or contained herein and as-

sumes no responsibility for anyone’s use of the information. Under no circum-

stances shall GARI or any of its participants or agents be liable for any direct,

indirect, incidental special, exemplary or consequential damages (including,

but not limited to: procurement of substitute good or services; loss of use,

data or prots; or business interruption) related to the content and/or to the

user’s subsequent use of the information contained herein, however caused

and on any theory of liability. User agrees to defend, indemnify, and hold

harmless GARI and its participants and agents from and against all claims

and expenses, including attorneys’ fees, arising out of the use of information

herein provided.

None of MSCI’s information or contributions constitute any form of invest-

ment advice, nor are they a recommendation or endorsement of any invest-

ment theme or strategy. For more information, please see msci.com/no-

tice-and-disclaimer.

The Unavoidable Opportunity: Investing in the Growing Market for Climate Resilience Solutions

Page 25 of 25

March 2024